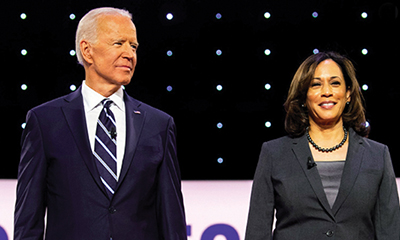

Additional relief of $7.7 billion in student loan debt for 160,500 debtors was approved today by the Biden-Harris Administration. Borrowers who are eligible for the shortened time-to-forgiveness benefit of President Biden’s Saving on a Valuable Education (SAVE) Plan, those receiving forgiveness on income-driven repayment (IDR) as a result of administration fixes, and those receiving Public Service Loan Forgiveness (PSLF) are all eligible for these discharges. This move follows the SAVE Plan’s success in assisting over 8 million debtors. Out of those, 4.6 million have a zero-dollar monthly payment.

With today’s announcement, the Biden-Harris administration has granted loan forgiveness to 4.75 million Americans, bringing the total amount to $167 billion. One in ten borrowers of federal student loans has now been granted some form of debt relief as a result of the initiatives taken by this administration. Efforts by President Biden and his administration to swiftly alleviate the burden of as many debtors as possible have been bolstered by this measure.

U.S. Secretary of Education Miguel Cardona stated, “The Biden-Harris Administration remains persistent about our efforts to bring student debt relief to millions more across the country. This announcement proves it.” “One in ten borrowers now has financial breathing room and a burden lifted” referring to the number of federal student loan debtors who have been authorized for debt relief.

A recent announcement regarding the time of the payment count adjustment was also made by the U.S. Department of Education (Department). Thanks to this administrative change, borrowers will now be able to claim their progress toward IDR forgiveness and PSLF. There is a new deadline of June 30, 2024, for borrowers who qualify to file for a loan consolidation.

The debt relief announced today is broken down into the following categories:

- $5.2 billion for 66,900 borrowers through fixes to PSLF: The Administration has now approved $68 billion in forgiveness for more than 942,000 borrowers through PSLF.

- $613 million for 54,300 borrowers through the SAVE Plan: This relief will go to borrowers enrolled in the SAVE Plan who had smaller loans for their postsecondary studies. Borrowers can receive relief after at least 10 years of payments if they originally borrowed $12,000 or less. Each additional $1,000 in borrowing adds 12 more months until forgiveness. All borrowers on the SAVE Plan receive forgiveness after 20 or 25 years, depending on whether they have loans for graduate school. The benefit is based upon the original principal balance of all Federal loans borrowed to attend school, not what a borrower currently owes or the amount of an individual loan. Today’s announcement brings total relief approved under the SAVE Plan to $5.5 billion for 414,000 borrowers.

- $1.9 billion for 39,200 borrowers through administrative adjustments to IDR payment counts. These adjustments have brought borrowers closer to forgiveness and address longstanding concerns with the misuse of forbearance by loan servicers. Including today’s announcement, the Biden-Harris Administration has now approved $51.0 billion in IDR relief for more than 1 million borrowers.

“Another 160,000 borrowers and their families will get some much-needed relief thanks to the continued efforts the Biden-Harris Administration to fix the broken student loan system,” said U.S. Under Secretary of Education James Kvaal. “We congratulate those borrowers on their due forgiveness and we will continue to work to deliver relief to others.”

As discussed in a recent report by the Council of Economic Advisers, the relief provided by these discharges and other actions taken by the Administration could boost short-term consumption and have positive effects on borrower mental health, financial security, and outcomes such as home ownership and entrepreneurship.

Fresh Approaches to Relieving Debt for Millions of Americans

The Biden-Harris administration unveiled preliminary proposals in April to reduce the amount of student loans owed by tens of millions of Americans. Including those whose debts have been cancelled during the last three years under the Biden-Harris administration, the proposed initiatives would increase the overall number of debtors qualified for student loan relief to more than 30 million. In order to swiftly alleviate the burden of as many borrowers as possible in accordance with the Higher Education Act, President Biden has announced plans for new regulations regarding student debt relief. This regulatory procedure commenced last summer. The following kinds of exemptions would be possible under the proposed rules:

- Waiving accrued and capitalized interest for millions of borrowers;

- Automatically discharging debt for borrowers not enrolled in but otherwise eligible for loan forgiveness under the SAVE Plan, closed school discharge, or other forgiveness programs;

- Eliminating student debt for borrowers who entered repayment 20 or more years ago;

- Helping borrowers who enrolled in low-financial-value programs or institutions; and

- Assisting borrowers who experience hardship in paying.

Public comments on the first set of plans closed on May 17. The Department is in the process of carefully reviewing comments. Our goal is to publish a final rule that results in delivering relief this fall.

A Strong Track Record of Borrower Assistance

The Biden-Harris Administration has taken many steps to reduce the burden of student debt and ensure that student loans are not a barrier to opportunity for students and families. The Administration secured a $900 increase to the maximum Pell Grant — the largest increase in a decade — and finalized new rules to protect borrowers from career programs that leave graduates with unaffordable debts or insufficient earnings.

Beyond the relief under IDR, the SAVE Plan, and PSLF, the Biden-Harris Administration has also approved:

- $28.7 billion for more than 1.6 million borrowers who were cheated by their schools, saw their institutions precipitously close, or are covered by related court settlements.

- $14.1 billion for more than 548,000 borrowers with a total and permanent disability